Many traders choose a simulated trading environment before entering the actual forex market. Forex trading simulators provide a risk-free platform for developing confidence, grasp market dynamics, and practice strategies. These instruments enable traders to improve their abilities without going through actual risk by simulating real-world trading environments.

What are Forex Trading Simulators?

Forex trading simulators are sophisticated software systems meant to simulate the conditions of the foreign exchange market, therefore enabling traders to practice trading free from the financial risk connected with actual trading. With real-time market data, these simulators create a virtual environment where users may run trades, examine market data, and create trading plans. Forex trading simulators are important tools for both new and seasoned traders by mimicking real trading situations.

Understanding Forex Trading Simulators

Simulations of forex trading let consumers trade in a risk-free environment. Live price feeds, charts, and trading tools are among the resources they usually provide that reflect actual market conditions. This lets traders get confidence and experience before joining the live market. These simulators mostly aim to enable traders grow their abilities, test methods, and grasp of market dynamics without regard to actual loss of money.

Does the simulator mirror the real market environment?

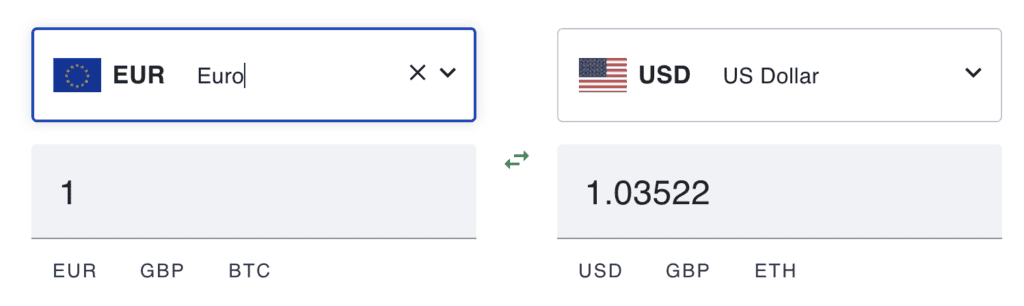

Real-time market data on a platform best for learning Forex and stocks online will enable you to closely monitor market swings. This information helps you to see how trade opportunities change over time. As a day trader or scalper, you can observe how even minutes could influence results; as an intraday trader, you can evaluate the effect of keeping a position for another day. With price swings just like those in the market, a trading simulator reflects actual account performance except you are using virtual money. Effective learning depends on trading using live data; without it, your decisions might not represent actual market activity, thereby restricting your progress and skill development.

Example of Forex Trading Simulator

Forex trading simulators are key tools for traders to refine their abilities and test methods in a risk-free environment. These are five best forex trading simulators together with their advantages.

- MetaTrader 4 (MT4)

Leading trading tool in the forex market, MetaTrader 4 is well-known for its simple interface and wide range of capabilities. Real-time market data and charts provided by MetaTrader 4 (MT4) let traders practice under actual circumstances. The platform offers automated trading with Expert Advisors (EAs) therefore improving trade efficiency by means of technical analysis tools for strategy testing.

- TradingView

Renowned for its sophisticated charting tools and paper trading function, TradingView is a web-based tool. For thorough market analysis, TradingView offers sophisticated charting with many chart types and indicators. Through letting traders exchange and talk about techniques inside its community, the platform promotes group learning. Custom alerts on particular price points or indications also help users optimize trading plans.

- Thinkorswim by TD Ameritrade

Strong platform Thinkorswim provides both FX and option traders with a complete paper trading capability. Thinkorswim provides in-depth analysis for well-informed decision-making by means of wide research tools. By means of their customizable interface, traders can personalize their workspace and therefore fit the platform to their particular requirements. The platform also includes risk management strategies such stop-loss orders, therefore enabling traders to properly control possible losses.

- NinjaTrader

Designed for FX and future traders, NinjaTrader is a software with a free simulation mode. Advanced charting and analytical tools from NinjaTrader give clever approaches for market research. Its market replay tool lets traders go back over former market situations, therefore facilitating practice in those conditions. The platform also offers strategy building, thereby enabling traders to construct and test strategies meant to improve their trading performance.

- Forex Tester

Software meant especially for forex trading, Forex Tester lets users replicate deals using past data. Forex Tester lets traders replicate past performance, therefore testing methods in many market environments. Customizing the simulation speed helps to enable thorough transaction analysis. The program also offers thorough performance analytics, complete reports for assessing and improving trading plans.

Advantage Of Trading Simulator?

Supported by examples to show their advantages, these are some main reasons to use trading simulators.

1. Risk-Free Learning Environment

Trading simulators have one of the most important benefits since they provide traders with a risk-free environment where they may study and hone their skills. Without worrying about losing actual money, new traders can play about with several techniques. A new trader could wish to test a scalping approach, for instance, whereby fast transactions are made to profit on minute price swings. By means of a simulator, individuals can hone their technique and implement this method free from the financial repercussions of a lost deal.

Example

Suppose Sarah, a rookie trader ready to join the forex market but worried about the risks involved. She chooses to hone her abilities on a trading simulator. Without jeopardizing any of her savings, Sarah examines several techniques—including trend tracking and breakout trading—over a few weeks. She starts to grasp the nuances of the market as she grows confidence and experience, therefore arming her for actual trading.

2. Realistic Trading Experience

Forex trading simulators replicate real market conditions, thereby offering a reasonable trading experience. Live market data, charts, and trading tools let users exercise their ideas in an environment quite similar to live trading. This exposure enables traders to grow familiar with the trading platform and strengthen under pressure their decision-making abilities.

Example

Suppose John, a trader who has been spending some months using a trading simulator. The simulator lets him place trades exactly as he would in a live environment and offers real-time statistics. Thanks to his great experience in the simulator, John feels at ease negotiating the trading interface and making decisions depending on real-time market conditions when he eventually moves to live trading.

3. Strategic Development and Testing

Before using any trading strategy in the real market, simulators let traders create and test several ones. Analyzing the success of several techniques over time helps traders find which one suits them the best. When trading actual money, this iterative process of testing and strategy improvement can result in more informed decisions.

Example

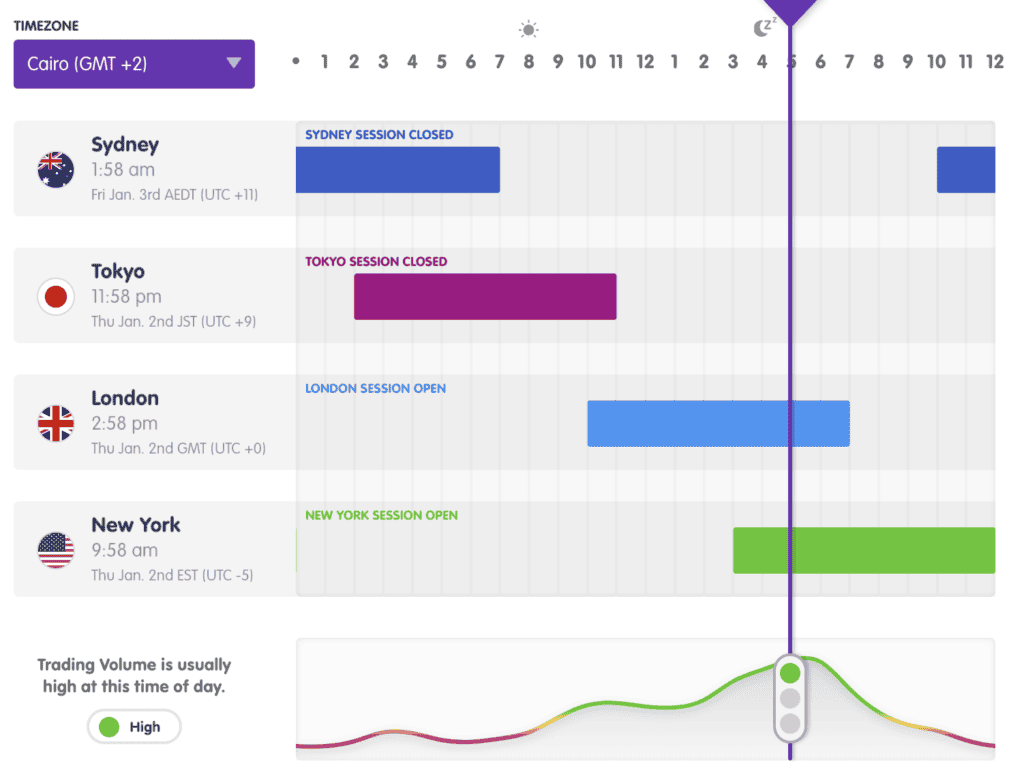

Alex, a trader, would like to create a new trading plan grounded on technical indicators. Over several weeks, he verifies his approach using a trading simulator, tracking performance under multiple market scenarios. Alex finds, after looking over the data, that his approach works best during the London trading session when volatility is greatest. This realization helps him to maximize his strategy and raise his chances of success once live trading start.

4. Building Confidence

New traders may find joining the forex market frightening. By letting users practice their abilities and view the outcomes of their trades without risking their funds, trading simulators help build confidence. Traders are more likely to start live trading with a good attitude as they get more at ease with their approaches and decision-making procedures.

Example

Novate trader Lisa starts honing her trading techniques using a trading simulator. She first finds it difficult to decide and control her feelings during deals. She starts to see consistent results, though, following many weeks of simulator practice. Her confidence is raised by her success; when she finally moves to live trading, she is more ready and confident in her skills.

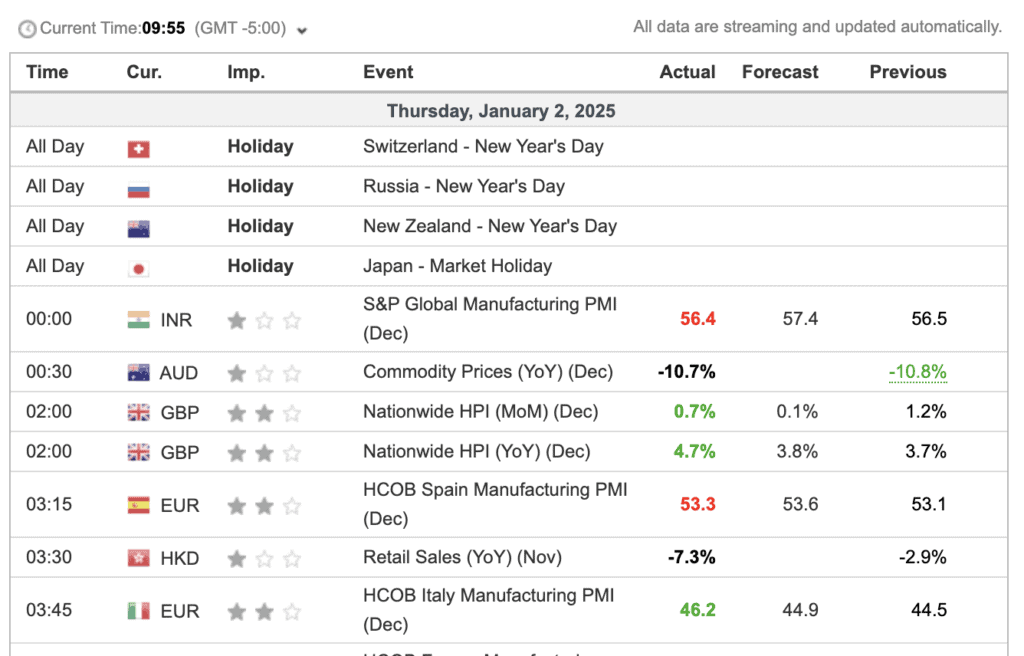

5. Learning Dynamics of Markets

Forex trading simulators give traders a great chance to learn about market dynamics, including how various economic indicators, news events, and geopolitical issues could affect currency values. Through simulated environment observations of different events, traders can have a better awareness of the elements influencing price fluctuations.

Example

Using a simulator, Michael, a trader, honed his trading amid major economic events including interest rate changes or Non-Farm Payrolls (NFP). Through tracking how these occurrences affect simulator currency values, he gains insight into expected market responses and changes his trading plans. When trading live, this information guides his decisions.

6. Performances Tracking

Performance tracking tools found in many trading simulators let users examine their trade data across time. Reviewing their win/loss ratios, average transaction length, and other important statistics helps traders understand their performance. Finding strengths and weaknesses from this information can be quite helpful for traders so they may modify their plans based on facts.

Example

Experienced trader Sophia makes advantage of a trading simulator including performance analytics. She looks over her performance data after a month of trading and finds that trading during particular market hours results in much greater win rate. Equipped with this knowledge, Sophia changes her trading plan to concentrate on certain times, therefore enhancing her general trading performance.

Key Features Of Simulators

Here are some of the main characteristics that make trading simulations useful for both new and seasoned traders.

1. Real-time Market Data

The ability of trading simulations to acquire real-time market data is among its most crucial aspects. This lets traders, like in a live trading environment, practice making decisions depending on present market conditions. Live price feeds let traders see how money pairs change in real-time, therefore helping them to grasp market dynamics.

For instance, a trader using a simulator can monitor EUR/USD pair price swings during major economic events including Non-Farm Payrolls (NFP). Through tracking the instantaneous effects of these announcements on market prices, the trader can develop to predict market responses and modify their approach.

2. User-Friendly Interface

Most trading simulators have simple interfaces that let users easily negotiate the platform. New traders who might not be familiar with trading tools and features depend critically on this accessibility. A well-designed interface facilitates users' concentration on learning and application of their techniques instead of on platform performance.

For instance, Emily, a new trader, can quickly access charts, indicators, and trading tools thanks to a simple architecture of a trading simulator. Her easy-to-use design lets her focus on honing her trading abilities free from overwhelming complexity.

3. Customizable Trading Settings

Users of trading simulators can often adjust their trading settings—that is, leverage, position sizes, and risk management limits. This adaptability helps traders fit their personal trading techniques and preferences with their practice sessions. Those who wish to replicate particular trading situations will find especially helpful customizing.

For instance, David, a trader, would rather maximize his possible returns by using more leverage. He can modify the leverage levels in the simulator to match his desired trading style, thereby learning risk management strategies and knowing how leverage influences his trading results.

4. Educational Resources

Many trading simulators have instructional tools like tutorials, seminars, and papers covering several trading subjects. While using the simulator, these tools might enable traders enhance their knowledge and abilities. Beginners wishing to learn the foundations of trading especially benefit from access to instructional resources.

For instance, a rookie trader called Sarah makes use of a simulator providing a set of technical analysis video tutorials. She can use these tools to expand her knowledge of chart patterns and indicators as she develops her trading skills, therefore improving her whole performance.

5. Community and Support

Certain trading simulators have community features including chat rooms or forums where users may interact, network, and get guidance from others. Customer service is also usually accessible to help consumers with any technological problems or inquiries they could run upon. Talking with a community of traders can offer insightful analysis and create a conducive learning environment.

Michael, a trader, for instance joins an online community connected to his trading simulator. By means of this community, he shares his trading experiences, gains knowledge from others, and gets comments on his approaches. This cooperative setting enables him to develop as a trader and get assurance in his skills.

6. Performance Analytics

Trading simulators must provide a basic ability for performance tracking. Users can examine their trading records, check their performance indicators, and get understanding of their trading style. Finding strengths and weaknesses from this information can be quite helpful for traders so they may modify their plans based on facts.

For instance, Lisa looks over her performance metrics after a month of trading in the simulator and finds that trading within designated market hours results in much greater win rate. Equipped with this knowledge, she changes her trading calendar to concentrate on certain hours, therefore enhancing her general performance.

Who Is Trading Simulator For?

The following are the main users and beneficiaries of a trading simulator:

- New to the forex market traders would find trading simulators perfect. Without running actual money, they offer a secure environment where one may learn the fundamentals of trading, grasp market dynamics, and build basic abilities.

- Simulators help even experienced traders as well. These systems help them to keep sharp and flexible by allowing them to test new ideas, improve current ones, and practice trading in several market scenarios.

- Students studying trade, finance, or economics can use simulators as part of their course of instruction. Simulators can be included into courses to give students practical learning chances and improve their grasp of trade ideas.

- Professional traders can test new trading systems or hone certain techniques using simulators before putting them into action in actual trading. This aids in the identification of possible risks and the best performance optimization strategy development.

- Trading simulators provide a means to investigate trading without financial risk for people reluctant to join the forex market because of the connected hazards. They can grow their trading talents at their own speed and get understanding of the market.

- Simulators let hobbyist traders—those who trade for extra money or as a pastime—practice and hone their skills free from financial loss's weight. This helps individuals to reduce risks and yet enjoy the trading experience.

- Simulators allow traders who are switching from other markets—such as stocks or commodities—to forex acquaint themselves with the special features of forex trading, including currency pairs, pips, and leverage.

- Investors seeking to investigate novel trading methods or tactics can utilize simulators to test their ideas in a controlled environment, therefore enabling them to assess efficacy before implementing them in active trading.

Final Words

Finally, forex trading simulators are vital tools for traders of all stripes since they provide a risk-free environment in which to hone trading techniques. Through access to real-time market data, customizable settings, and performance analytics, these simulators let users create successful trading strategies and boost confidence before joining the genuine market. Trading simulators enable a thorough learning experience regardless of your level of experience—from novice wishing to learn the fundamentals to experienced trader trying new strategies. Using these simulators will help a trader greatly improve their knowledge and performance as the forex market develops, so increasing their chances of success in the competitive scene of forex trading.

FAQ

Are Forex Simulators Reliable?

Forex simulators replicate trades using real-time or historical data, hence they are usually accurate in reflecting market circumstances. The accuracy derives from the capacity to replicate real market movements, which helps traders test methods under circumstances somewhat similar to live trading. Though they can simulate market behavior and price action, simulators might not completely reflect the emotional component of trading with actual money, which could influence decisions in live markets.

Are free trade simulations available?

Particularly those linked with well-known trading platforms like MetaTrader 4 and TradingView, many trading simulators are available for free. Usually featuring simple tools that let traders experiment without running actual risk, these free versions provide. Some sophisticated simulators or other tools, including in-depth analytics or extended historical data, can, however, call for a membership or one-time fee.